dependent care fsa eligible expenses

The Grace Period for the 2022 Dependent Care FSA provides eligible participants with an additional 2 12 months January 1 to March 15 to incur dependent care expenses for reimbursement from. You may be eligible to claim the child and dependent care credit if.

Your Handy List Of Fsa Eligible Expenses Pdf Employers Resource

January 1 2022 - March 15 2023 Grace Period.

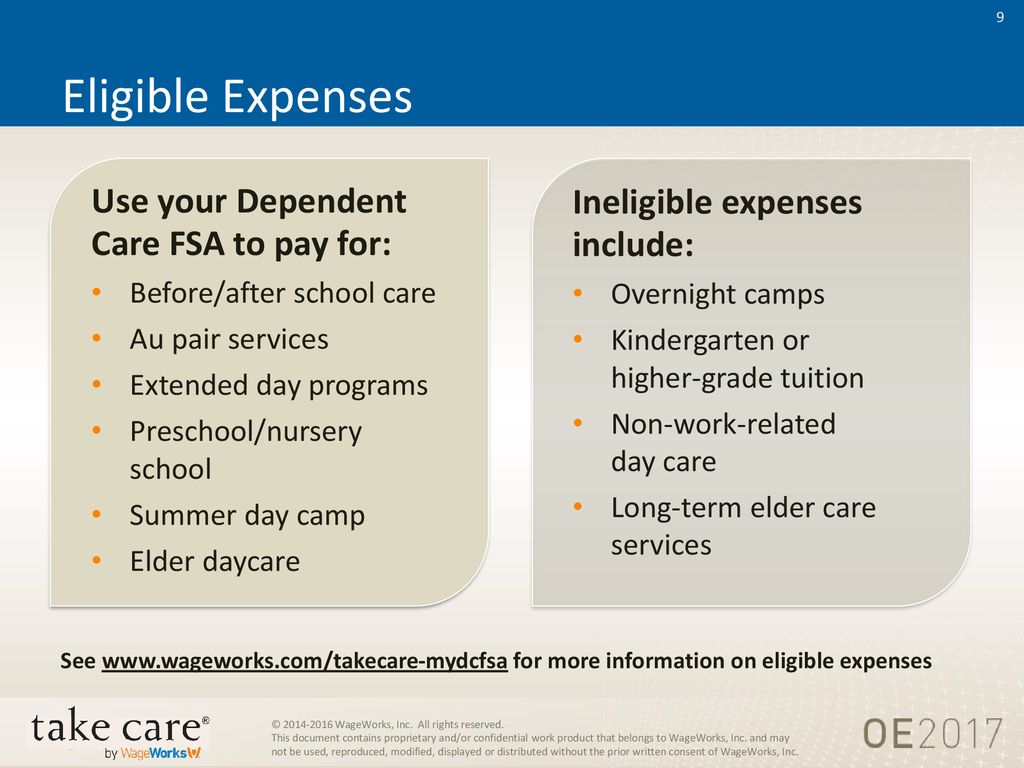

. Registration fees required for eligible care after actual services are received Sick-child care center. Preschoolnursery school for pre-kindergarten. A dependent care flexible spending account DCFSA is an employer-provided tax-advantaged account for certain dependent care expenses.

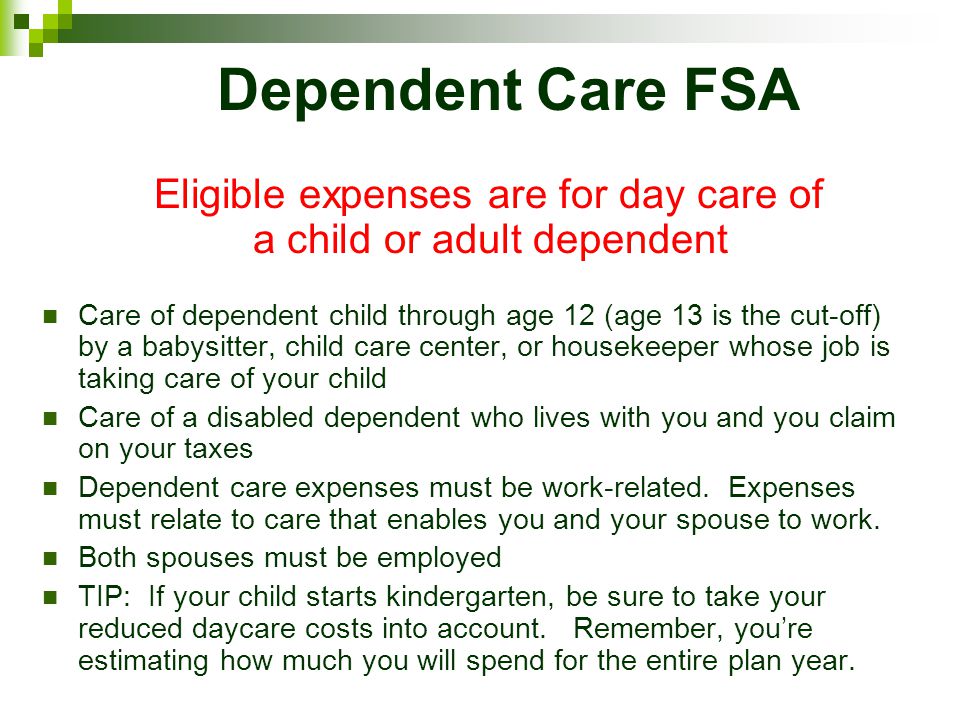

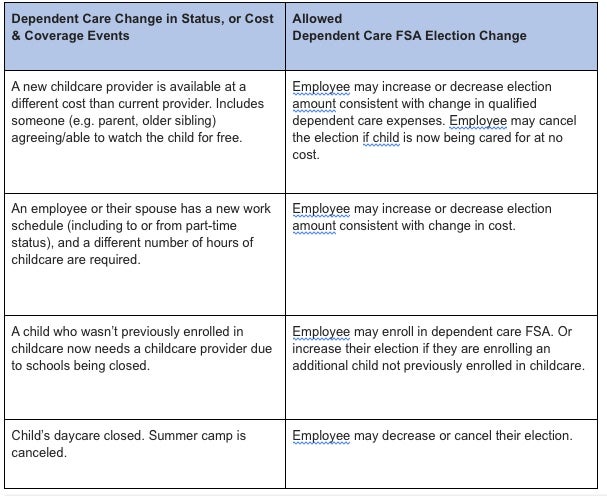

To qualify as an eligible expense the babysitters services must allow you. 1 2021 changes impacting both the Health Care and Dependent Care FSAs can be found below. Expenses are generally only considered eligible for reimbursement under the Dependent Care Flexible Spending Account when the expense enables the employee and spouse if applicable to be gainfully employed or seek employment.

Consequently some health and dependent care FSA participants had lower or no eligible expenses and were at risk of losing funds they had already contributed or elected to contribute for the current plan year. Get a free demo. Licensed day care centers.

The Savings Power of This FSA. Summer camps for dependent children under age 13. January 1 2022 - December 31 2022 Grace Period if eligible.

All unused cash can be carried over and used throughout the year. Placement fees for a dependent care provider such as an au pair. Dependent Care FSA Eligible Expenses.

Payroll taxes related to eligible care. Private school tuition for kindergarten and up Registration fees required for eligible child care after actual services are received. Ad Custom benefits solutions for your business needs.

Below are the basic rules followed by our interpretation as they relate to standard service providers. 2022 Dependent Care FSA. Employers might also increase the grace period from 25 months to 12 months.

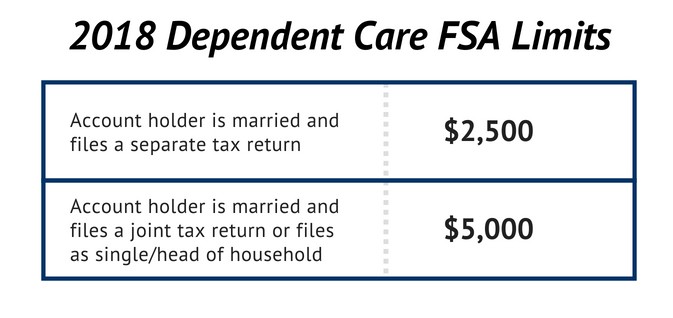

The Maximum Amount You Can Put Into Your Dependent Care Fsa For 2022 Is 5000 For Individuals Or Married Couples Filing Jointly Or 2500 For A Married Person Filing Separately. Easy implementation and comprehensive employee education available 247. Before school or after school care other than tuition Qualifying custodial care for dependent adults.

Cover expenses for your childdependent. Ad Explore cost-saving strategies that wont reduce your employees benefits. Medical care for children or dependent adults Nanny for children Nursery school.

A Dependent Care FSA can cover expenses paid to a babysitter under the age of 19 as long as they are not your or your spouses child stepchild foster child or tax dependent. If you exclude or deduct dependent care benefits provided by a dependent care benefit plan the total amount you exclude or deduct must be less than the dollar limit for qualifying expenses generally 8000 if you had one qualifying person or 16000 if. Nursing home care for dependent adults Payroll taxes related to eligible dependent care.

A dependent care fsa flexible spending account can help you stretch your child care budget by providing tax-free money for these expenses. Piano lessons for children Preschool. Its goal is to help cover the costs of providing professional care so that the caregiver can work look for.

Elevate your health benefits. An exception may apply when the spouse is a full-time student or incapable of self-care. Adult day care facilities.

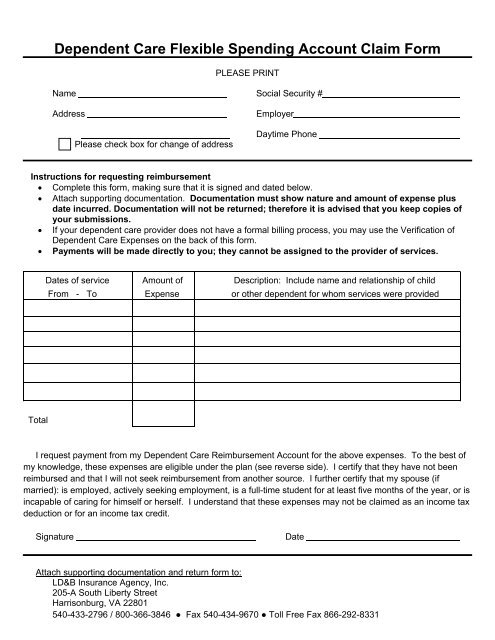

The IRS has outlined a list of Dependent Care FSA eligible expenses. You can use your FSA funds to pay for a variety of expenses for you your spouse and your dependents. The IRS determines which expenses can be reimbursed by an FSA.

To find out which expenses are covered by FSAFEDS select the account type you have from the list below. 16 rows The IRS may request itemized receipts to verify the eligibility of your expenses. In response the IRS in May 2020 and Congress in December 2020 adopted temporary rules.

Ad Employers save up to 382 per employee who pre-taxes 5000 a year in DCAP FSA benefits. Plan Year Benefit Period. Dependent Care Expenses Must be for Care Employees dependent care expenses are eligible for reimbursement under the dependent care FSA only if the expenses are employment-related which means they enable the employee and spouse to be gainfully employed by providing care to a qualifying individual.

Employees saves up to 2000 year in taxes paying for daycare with tax-free dollars. You or your spouse if filing a joint return lived in the United States for more than half of the year. Dependent Care FSA Eligible Expenses.

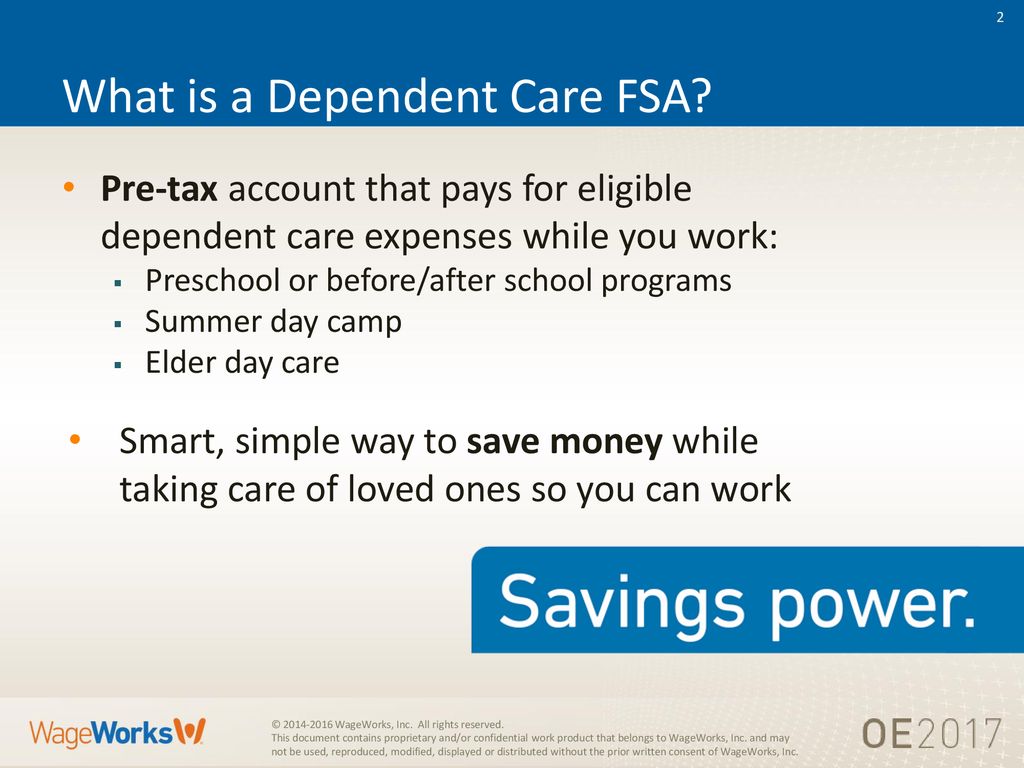

Eligible employees can allocate a portion of their pay to be put into a special flexible spending account to later be reimbursed for qualifying out-of-pocket dependent care expenses. If youre enrolled in a dependent care flexible spending account DCFSA you can use your pre-tax funds to cover expenses for your childdependent under the age of 13 as well as adult dependents based on dependents you claim on your tax returns for dependent care while you or your spouse work or look for work. A Dependent Care FSA DCFSA is a pre-tax benefit account used to pay for eligible dependent care services such as preschool summer day camp before or after school programs and child or adult daycare.

Nursery schools or pre-schools. Dependent care FSA-eligible expenses include. Limited Expense Health Care FSA.

Its a smart simple way to save money while taking care of your loved ones so that you can continue to work. Dependent care benefits include tax credits and employee benefits such as daycare allowances for the care of their dependents. The expenses must enable you and your spouse to work or look for a new job.

Either option has the same result. Customized industry-leading solutions that have an average ROI of over 1700. Dependent Care Flexible Spending Account eligible expenses are more expansive than many parents realize and narrower than others hope.

Transportation to and from eligible care provided by. You paid expenses for the care of a qualifying individual to enable you and your spouse if filing a joint return to work or actively look for work.

Dependent Care Open Enrollment 24hourflex

How A Dependent Care Flexible Spending Account Can Help Your Family Austin Benefits Group

2021 Wake Forest Benefits Guidebook By Wfu Talent Issuu

Health Care And Dependent Care Fsas Infographic Optum Financial

File A Dca Claim American Fidelity

Dependent Care Fsa Flexible Spending Account Ppt Download

Message For 2020 Dependent Care Fsa Participants Office Of Faculty Staff Benefits Georgetown University

How A Dependent Care Fsa Can Enhance Your Benefits Package

Dependent Care Flexible Spending Account Claim Form

Using Your Dependent Care Fsa To Pay For Daycare Quality For Kids

How To File A Dependent Care Fsa Claim 24hourflex

Dependent Care Fsa Flexible Spending Account Ppt Download

Why You Should Consider A Dependent Care Fsa

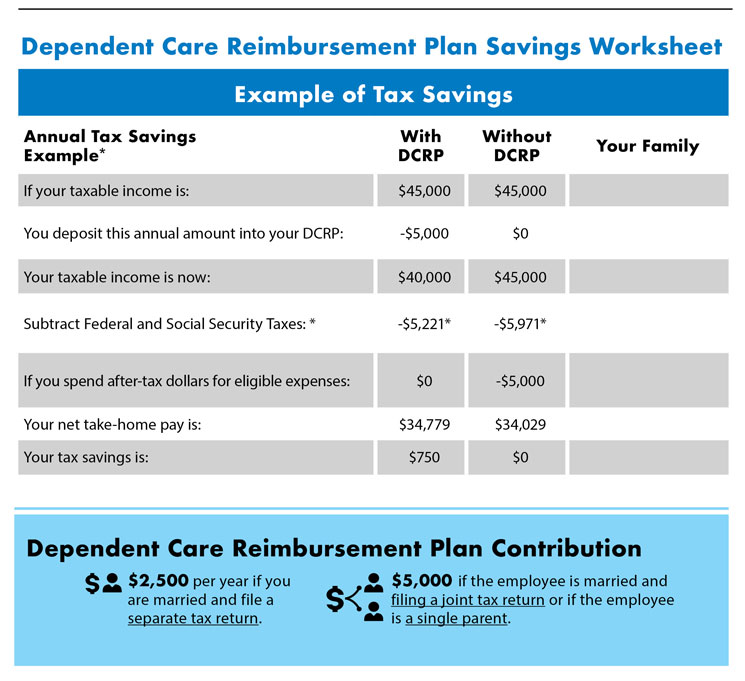

Coh Dependent Care Reimbursement Plan

What Is A Dependent Care Fsa Wex Inc