vermont state tax exempt form

This form may be photocopied. The level of the exemption varies from 10000 - 40000.

State Tax Exemption Information for Government Charge Cards.

. The certificate is signed dated and complete all applicable sections and fields completed. Standard Short Form 12122018 Revised. The property purchased is of a type ordinarily used for the stated purpose or the exempt use is explained.

A previous Vermont or out-of-state title indicating the applicants ownership. 280 State Drive Waterbury Vermont 05671-1010 Phone. Do I need a form.

Centrally Billed Account CBA cards are exempt from state taxes in EVERY state. ˇ ˆ Form S-3C Rev. Form S3 Resale and Exempt Organization Certificate of Exemption is not.

Registration Tax Title Form form VD-119. I the Contract Term is more than 12 months. 604 The completed certificate should be given to the seller who must retain it for at least three years after any exempted sale.

A motor vehicle may be exempt from taxation if it is a gift or inheritance as defined under 32 VSA 8911 8. The exemption reduces the appraised value of the home prior to the assessment of taxes. Vermont Sales Tax Exemption Certificate for AGRICULTURAL FERTILIZERS PESTICIDES MACHINERY EQUIPMENT 32 VSA.

State law mandates a minimum 10000 exemption although towns are given the option of increasing the exemption to 40000. Other Forms This is a list of forms from GSA and other agencies that are frequently used by GSA employees. An eligible veteran lives in a home valued at 200000.

803 Vermont Sales Tax Exemption Certificate for CONTRACTORS 32 VSA. Standard Contract for Services 12-12-2018 - Revised. The certification is on an exemption form issued by the Vermont Department of Taxes or a form with substantially identical language.

An original or a certified copy of a previous Vermont or out-of-state registration indicating the applicants ownership. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. Religious Immunization Exemption Child Care and Schools Vermonts Immunization Rule adopted pursuant to 18 VSA.

The most secure digital platform to get legally binding electronically signed documents in just a. Line-by-line instructions for complex tax forms can be found next to the file. The veterans town provides a 20000 exemption.

The property purchased is of a type ordinarily used for the stated purpose or the exempt use is explained. Form S-3F can be found on our website at wwwtaxvermontgov. Visit GSA SmartPay to find state tax exemption forms andor links directly to state websites.

Go to myVTax for more information. State Tax Exempt Forms. Vermont Sales Tax Exemption Certificate Who do I contact if I have a question.

Use of this Short Form is not authorized and the Standard State Contract Form must be used if any of the following apply. Standard Contract form template for Services. Certain states require forms for CBA purchase cards and CBA travel cards.

Ad Download Or Email Form S-3 More Fillable Forms Register and Subscribe Now. PdfFiller allows users to edit sign fill and share all type of documents online. Vermont Department of Taxation Additional information or instructions.

PROPERTY TAX EXEMPTION FOR DISABLED VETERANS AND THEIR SURVIVORS The State of Vermont offers a property tax discount reduction on the assessed value of the primary residence of a 50 or more disabled veteran as rated by the Federal VA and their survivors. File your return electronically for a faster refund. Sales tax exemption applies to hotel occupancy.

How to use sales tax exemption certificates in Vermont. Vermont Department of Motor Vehicles 120 State Street Montpelier VT 05603-0001. Fill out securely sign print or email your vermont s 3c sales exemption certificate form instantly with SignNow.

To request exemption of tax based upon gift when a vehicle was previously registered andor titled by the donor and is gifted with no money exchange and no current lienholder to be listed to a family member as defined acceptable by this form. Please note that the DVHA 13 Homestead Exemption Form needs to be completed when sending in either the DVHA 14 Caregiver Exemption Request Form or the DVHA 15 Household Income Below 300 percent of the Federal Poverty Level Exemption Form. 97413 974125 Form S-3A.

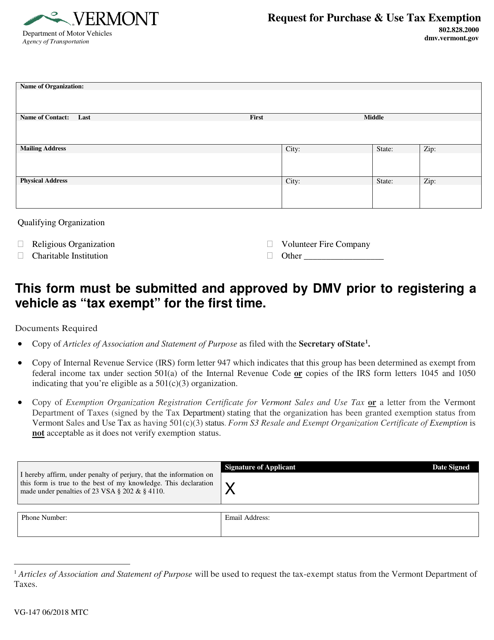

A copy of Exemption Organization Registration Certificate for Vermont Sales and Use Tax or a letter from the Vermont Department of Taxes signed by the Tax Department stating that the organization has been granted exemption status from Vermont Sales and Use Tax as having 501 c 3 status. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. 53 rows Present completed VT Resale and Exempt Organization Certificate of Exemption VT Form S3 PDF.

Vermont Sales Tax Exemption Certificate Form. Such as the GSA SmartPay travel card for business travel your lodging and rental car costs may be exempt from state sales tax. Find federal forms and applications by agency name on USAgov.

1123 applies to any child or student attending any center-based or family child care facility public or independent kindergarten elementary and secondary schools. Ad Download Or Email Form S-3C More Fillable Forms Register and Subscribe Now. Ii the Maximum Amount is more than.

802 828-2551 Important links. Denver lodging sales tax requires the Standard Municipal Home Rule Affidavit of Exemption Sale Form PDF Connecticut CT. The applicant must furnish one of the following proofs of ownership in order of preference.

To qualify for the exemption the motor vehicle must be registered andor titled in Vermont or any other jurisdiction in. Farms Farmsude incl enterprises using land and improvements for agricultural production for sale. The certificate is signed dated and complete all applicable sections and fields completed.

Vermont Department of Taxation. The certification is on an exemption form issued by the Vermont Department of Taxes or a form with substantially identical language. Form S-3F Vermont Sales Tax Exemption Certificate for Fuel or Electricity isompleted c if the use is not obvious or if only a portion of the fuel purchased is exempt.

Some cities have local taxes. VT-013-Gift_Tax_Exemptionpdf 20754 KB File Format. Vermont Meals and Rooms Info Updated 112519.

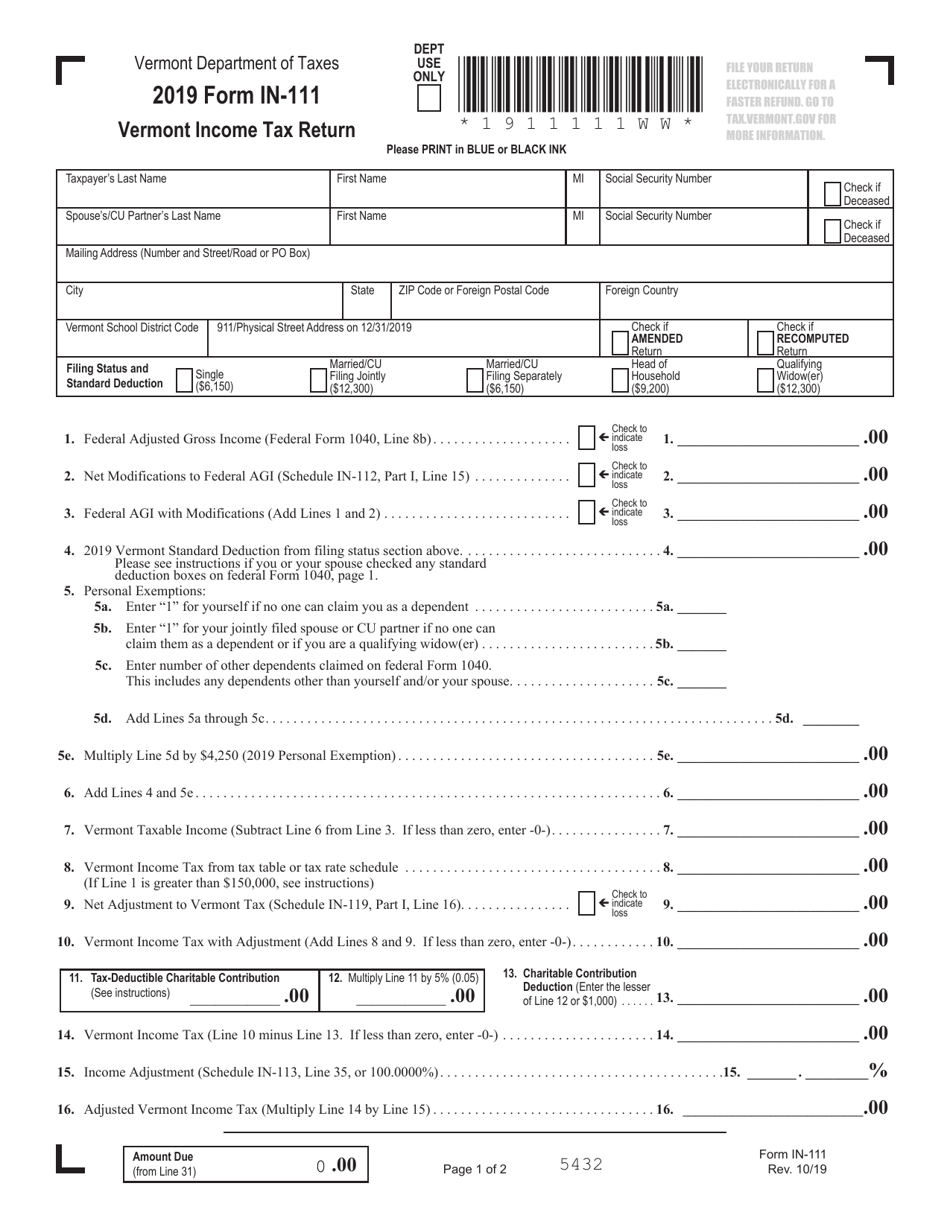

Form In 111 Download Fillable Pdf Or Fill Online Vermont Income Tax Return 2019 Vermont Templateroller

Sales Tax Exemption Certificate Fill Online Printable Fillable Blank Pdffiller

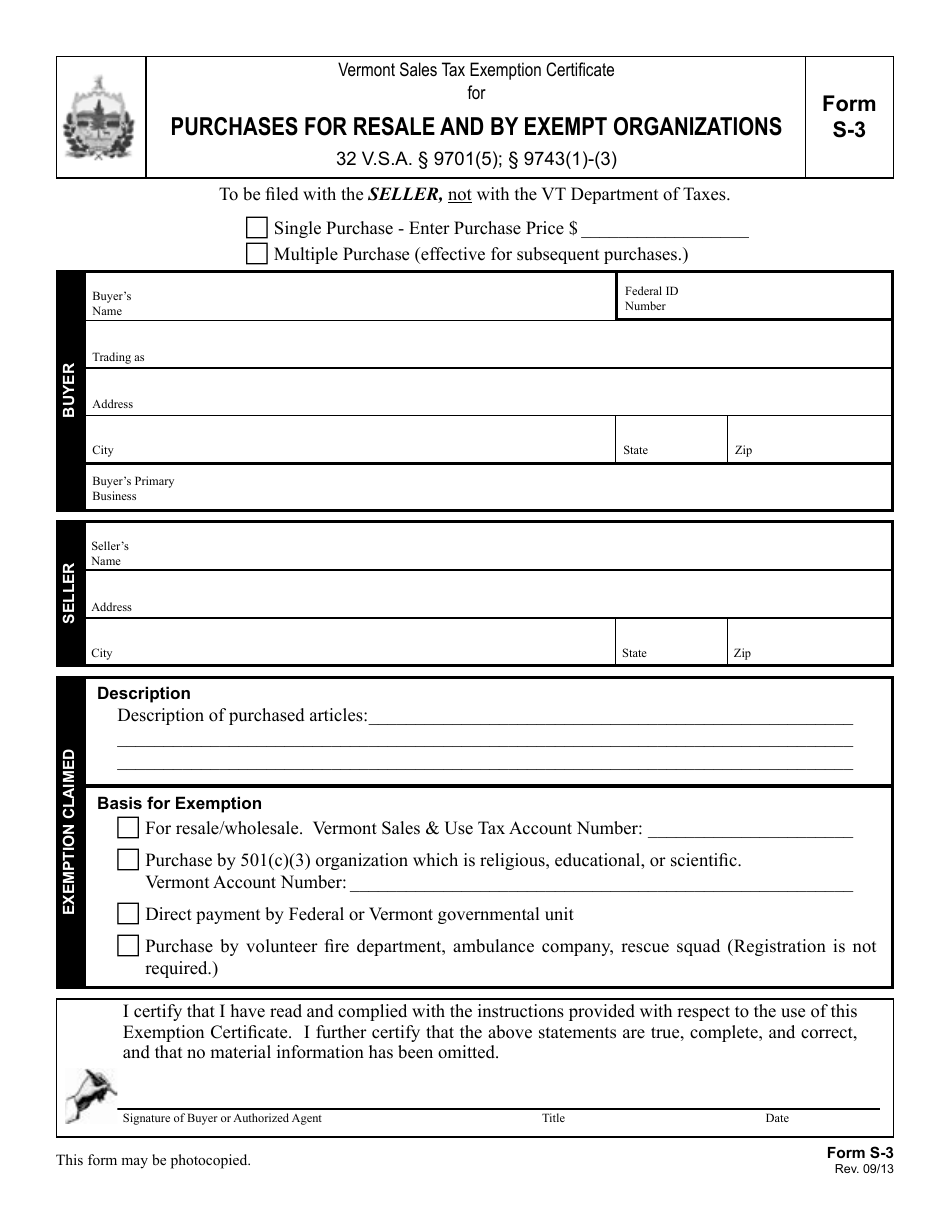

How To Get A Certificate Of Exemption In Vermont Startingyourbusiness Com

Louisiana Tax Forms 2021 Printable State La Form It 540 And La Form It 540 Instructions

Fillable Multistate Exemption Certificate Fillable Fill Online Printable Fillable Blank Pdffiller

Vt Form S 3 Download Printable Pdf Or Fill Online Purchases For Resale And By Exempt Organizations Vermont Templateroller

Adr Neutral Application Tennessee Application The Unit

Form Vg 147 Download Fillable Pdf Or Fill Online Request For Purchase Use Tax Exemption Vermont Templateroller

Form St 5 Sales Tax Exempt Purchaser Certificate Mass Gov

What Is A Schedule C Tax Form H R Block

Fillable Online Vermont Sales Tax Exemption Certificate For Form Resale Fax Email Print Pdffiller

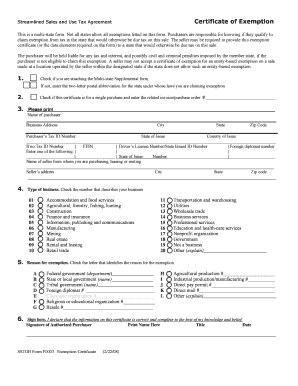

Fillable Online Revenue Ne Streamlined Sales Tax Form Fillable Fax Email Print Pdffiller

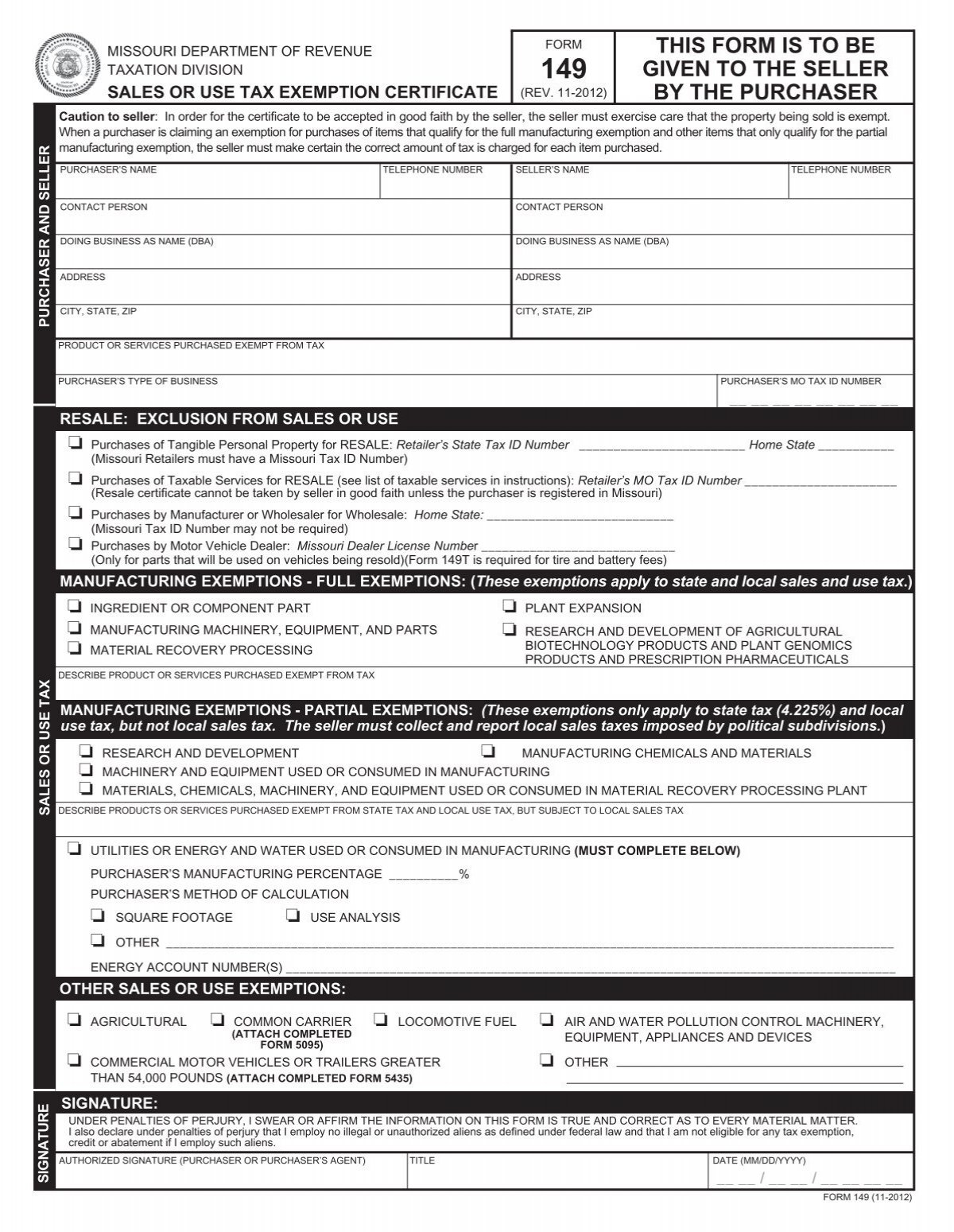

Form 149 Sales And Use Tax Exemption Certificate Missouri

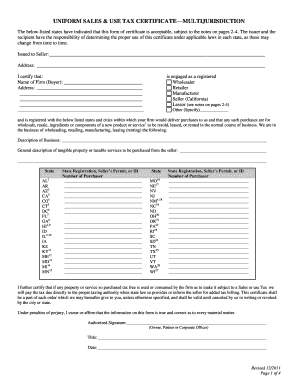

Multi Jurisdictional Tax Form Fill Out And Sign Printable Pdf Template Signnow

Printable Vermont Sales Tax Exemption Certificates

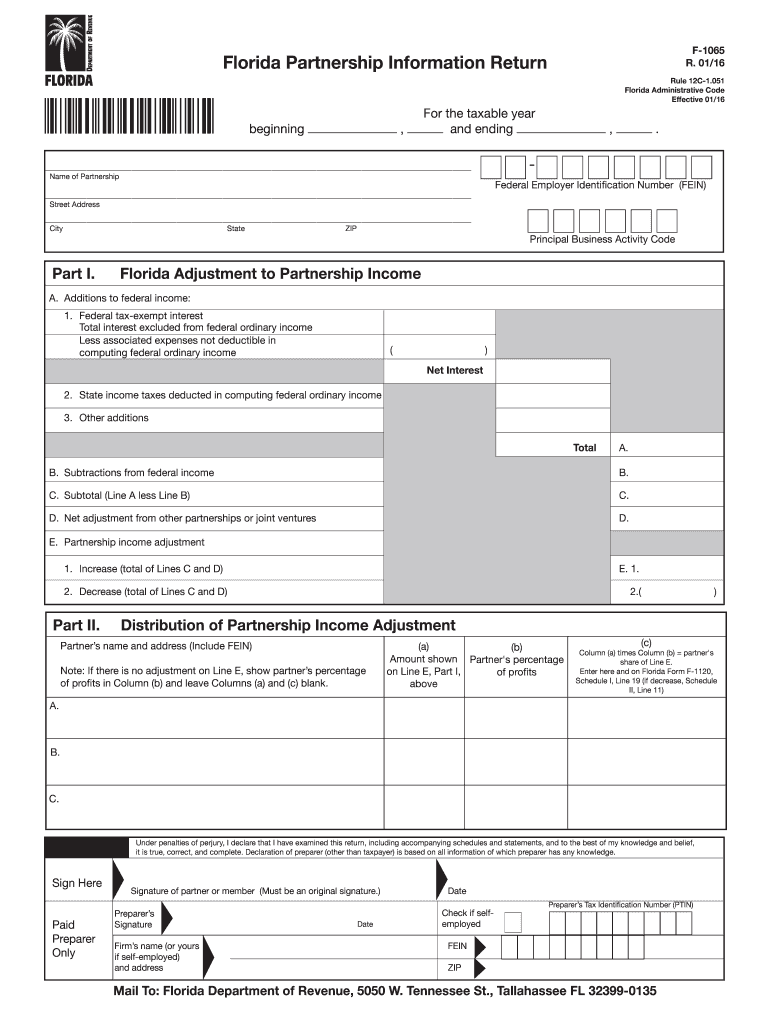

Fl Dor F 1065 2016 2022 Fill Out Tax Template Online Us Legal Forms