nj property tax relief homestead benefit

Phil Murphy unveiled Thursday. NEW JERSEY - New Jersey Gov.

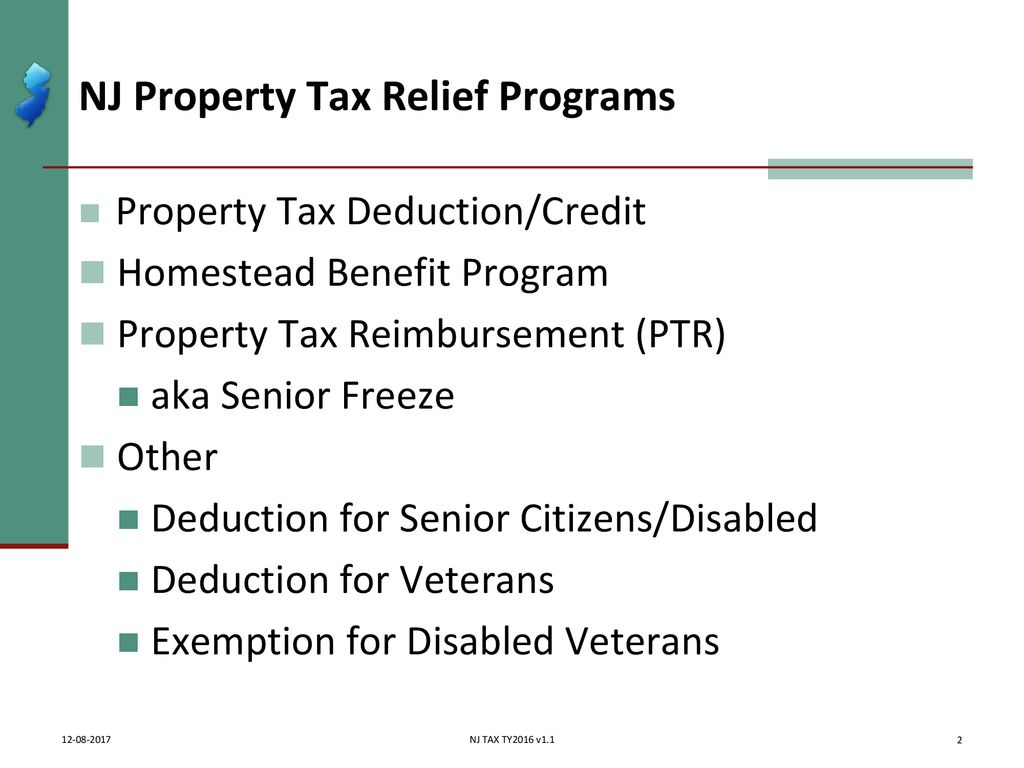

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download

FAIR LAWN Building on his commitment to making New Jersey stronger fairer and more affordable Governor Phil Murphy today unveiled the ANCHOR Property Tax Relief.

. You must have been a New Jersey resident who owned and occupied the home as a. If your primary residence is in New Jersey and you paid your property taxes in the year you may be able to get a tax credit of up to 1000. Nearly 18 million homeowners and renters would get property tax rebates averaging 700 next year under a new plan Gov.

The latest round of benefits scheduled to be paid in May 2022 are intended to offset the property-tax bills from 2018. If you answer yes and later sell your home after filing this application the only way to receive your 2018 Homestead Benefit is to negotiate it at the closing of your property sale. 1 real estate tax bills a state treasury official said Wednesday.

Renters making up to 100000 would be. And Your 2018 New Jersey gross income was not. Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today.

Credit on Property Tax Bill. The NJ Homestead Benefit reduces the taxes that you are billed. Multiplying the amount of your 2017.

The 2021 property tax credits are based on ones 2017 income and property taxes paid. 2018 Homestead Benefit. We do not send Homestead Benefit filing information to homeowners whose New Jersey Gross Income for the application year was more than the income limits established by the State Budget.

Funding for the property. New Jerseys lowest-income senior and disabled homeowners would get the biggest benefits under the expanded direct property-tax relief program Gov. Eligible seniors or disabled people with New Jersey gross income of up to 100000 would get a credit worth 5 of their 2006 property taxes.

Phil Murphy announced Thursday his administration will extend property tax relief to about 18 million New Jersey households by replacing the states Homestead Benefit. Most recipients get a credit on their tax bills. If you owned more than one property in New Jersey you were to only file the application for the property that was your principal residence on October 1 2016.

And over the past five years the average. File Online or by Phone. Ad 2022 Homeowner Relief Program is Giving a One Time 3627 StimuIus Check.

Phil Murphy announced more homeowners and renters would receive property tax relief under his new program- ANCHOR- which would. For New Jersey homeowners making up to 250000 rebates would be applied as a percentage of property taxes paid up to 10000. The 2018 property taxes were paid on that home.

To apply for the refund complete and submit the. You can get information on the status amount of your Homestead Benefit either online or by phone. Earlier this year NJ Spotlight News.

If your 2018 New Jersey Gross Income is. Allow at least two weeks after the expected delivery date for your county before contacting the Homestead Benefit Hotline at 1-888-238-1233 or visiting a Regional Information Center for. Property Tax Relief Programs.

Because the benefit is no longer handled as a rebate it is no longer accounted for on your federal or NJ. New Jersey homeowners will not receive Homestead property tax credits on their Nov. Your benefit payment according to the FY2022 Budget appropriation is calculated by.

Online Inquiry For Benefit Years. Under a proposal Murphy unveiled Thursday New Jersey homeowners making up to 250000 annually would be eligible to receive state-funded property-tax relief benefits. Your tax collector issues you a property tax bill or advice copy reflecting the amount of your.

Benefits are expected to be credited to eligible taxpayers in two payments first in. Same old end run. The filing deadline for the latest Homestead.

2018 Homestead Benefit payments should be paid to eligible taxpayers beginning in May 2022. The benefit gives property tax relief to eligible homeowners in the form of a credit that is. The filing deadline for the 2018 Homestead Benefit was November 30 2021.

Moreover the average property-tax bill has increased by more than 40 since 2006 according to the states most recent tax data. Tenants The amount appropriated for property tax relief programs in the State Budget.

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download

Governor Phil Murphy Tax Relief Is A Critical Component Of A Stronger And Fairer New Jersey With Middle Class Tax Rebates An Expansion Of Our Earned Income Tax Credit The Long Overdue Updating

Property Tax Relief Programs West Amwell Nj

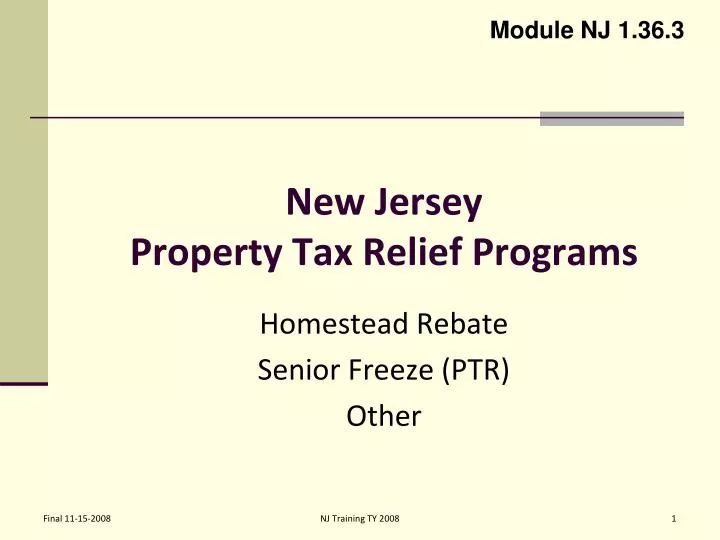

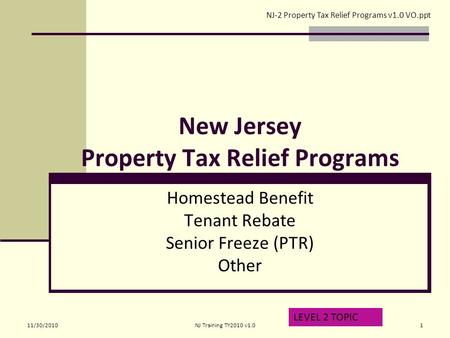

Ppt New Jersey Property Tax Relief Programs Powerpoint Presentation Free Download Id 4440099

Tax Assessment And Collection News Announcements West Amwell Nj

Property Tax Relief Programs West Amwell Nj

Gov Murphy Announced His Administration Will Extend Property Tax Relief To About 1 8 Million Residents Through An Overhaul Of The State S Homestead Benefit Program Homeowners Making Up To 250k Would Be Eligible

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download

Nj Property Tax Relief Program Updates Access Wealth

Tax Refund Programs Unfunded Due To Covid S Impact

Property Tax Deduction Credit Eligibility Requirements All The Following Must Be Met You Must Have Been Domiciled And Maintained A Principal Residence Ppt Download

Homestead Benefit Filing Wyckoff Nj

Governor Murphy Announces Property Tax Relief Program Morristown Minute Newsbreak Original

New Jersey Property Tax Relief Programs Property Tax Deduction Or Credit Homestead Benefit Senior Freeze Ptr Other Nj 2 Property Tax Relief Programs Ppt Download

New Jersey Property Tax Relief Programs Property Tax Deduction Or Credit Homestead Benefit Senior Freeze Ptr Other Nj 2 Property Tax Relief Programs Ppt Download